San Diego, CA, December 17, 2025

As artificial intelligence demand grows, Bank of America identifies key players in the energy and utilities sector to watch. Their top stock picks include Public Service Enterprise Group, Alliant Energy, Sempra, Southwest Gas, and Xcel Energy. These companies are set to benefit from the rising data center needs crucial for AI infrastructure, promising significant growth potential amidst evolving tech landscapes.

BofA’s Top Stock Picks in the AI-Powered Energy Sector

Investing Insight into Energy and Utility Stocks

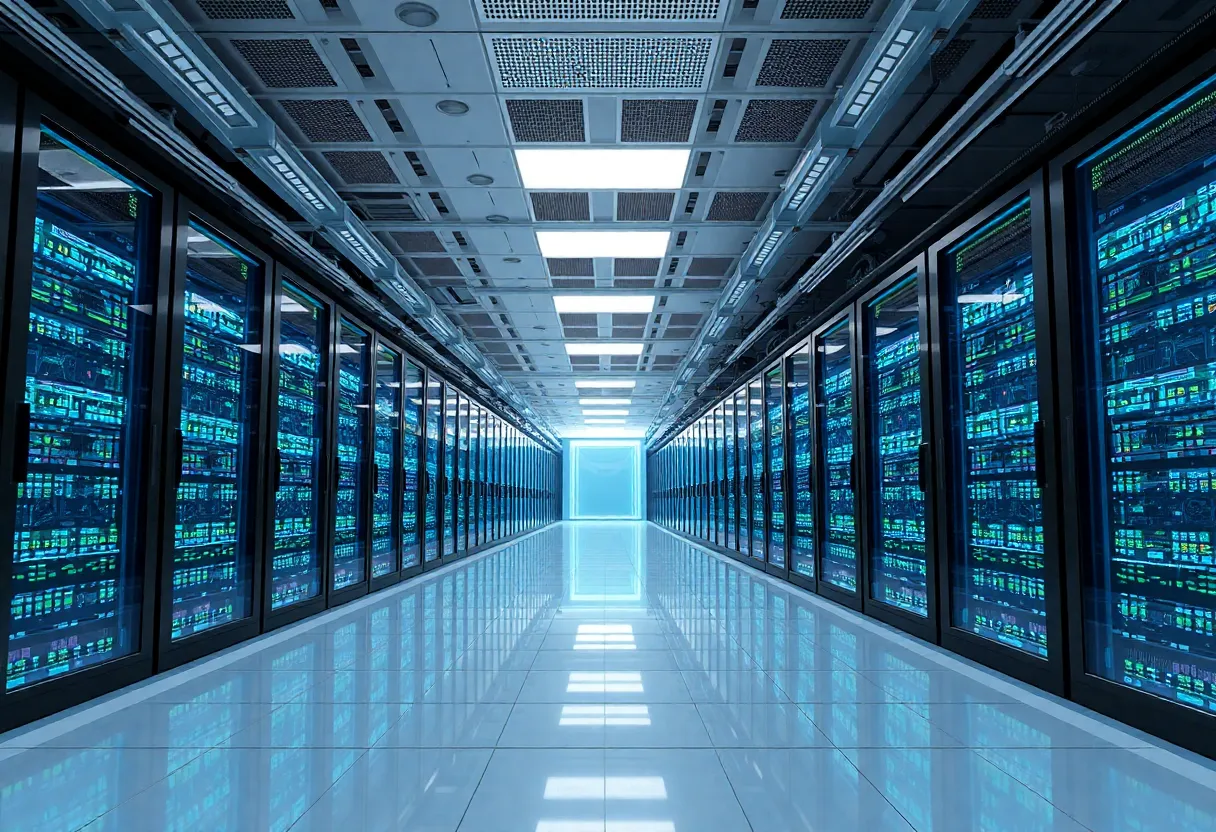

San Diego, CA – As the demand for artificial intelligence (AI) continues to surge, driven largely by the need for extensive data processing, Bank of America (BofA) has identified key players in the energy and utilities sector that are likely to benefit from this developmental wave. Their assessment includes five notable stock picks poised for growth as data centers multiply to meet increasing resource demands.

Entrepreneurs and investors in San Diego County can appreciate the resilience and innovation within this sector. The ongoing development of data centers relies on the secure provision of energy and utilities, revealing the crucial role these companies will play in the future of technology infrastructure. Limited regulation in the energy sector may further foster competitive growth, adding to the appeal of these investment opportunities.

Top Stock Picks

- Public Service Enterprise Group (PSEG)

- Alliant Energy Corporation (LNT)

- Sempra (SRE)

- Southwest Gas (SWX)

- Xcel Energy (XEL)

Investment Rationale

BofA’s analysts underscore that these companies are strategically positioned to capitalize on the surge in data center construction essential for AI infrastructure development. The escalating demand for data processing and storage solidifies their status as pivotal players in the rapidly evolving AI landscape.

Company Profiles

- Public Service Enterprise Group (PSEG): An energy holding company engaged in electricity and natural gas distribution. BofA expresses a “Buy” rating with a $95 price target, underlining PSEG’s stability and the potential for gains associated with increasing electricity prices.

- Alliant Energy Corporation (LNT): This company operates in the Midwest, providing natural gas and electricity. BofA has a “Buy” rating and a $74 price target, spotlighting Alliant’s growth potential, particularly in regions with burgeoning data centers.

- Sempra (SRE): Focusing on electricity and natural gas markets in California and Texas, BofA maintains a “Buy” rating with a $99 price target. Their analysis highlights Sempra’s prospects benefiting from the stable California data center market and Texas’s ongoing expansion.

- Southwest Gas (SWX): Specializing in natural gas production, transportation, and distribution, BofA has a “Buy” rating and an $84 price target, concentrating on its strategic markets in California, Arizona, and Nevada as vital to the data center growth.

- Xcel Energy (XEL): Serving states including Colorado, Michigan, and North Dakota, the company is part of an expanding data center market. BofA’s “Buy” rating with an $84 price target projects a growth rate of 6-8% through the end of the decade, driven by data center developments.

Market Outlook

With an eye on the future, BofA forecasts that 2026 will represent the midpoint of an 8-10 year journey toward upgrading traditional IT infrastructure to accommodate accelerated AI workloads. This period is expected to see continued robust growth in AI semiconductors, propelled by strong data center utilization, constrained supply chains, and heightened enterprise engagement in the rapidly maturing AI landscape.

Conclusion

As the infrastructure needs for AI grow, the energy and utilities sector offers a promising landscape for investment. BofA’s recommended stock picks are well-positioned to leverage the expanding market for data centers, providing significant growth potential for those looking to invest in this evolving economic sector. Supporting local energy companies could significantly contribute to San Diego’s ongoing economic development as they navigate the needs of a technology-savvy future.

- What are BofA’s top stock picks in the energy and utilities sector?

- BofA’s top stock picks are Public Service Enterprise Group (PSEG), Alliant Energy Corporation (LNT), Sempra (SRE), Southwest Gas (SWX), and Xcel Energy (XEL).

- Why are these companies considered top picks?

- These companies are well-positioned to benefit from the surge in data center construction, which is essential for AI infrastructure, due to the increasing demand for data processing and storage.

- What is BofA’s outlook for the AI infrastructure market?

- BofA forecasts that 2026 will mark the midpoint of an 8-10 year journey of upgrading traditional IT infrastructure for accelerated and AI workloads, anticipating another year of solid growth in AI semiconductors driven by strong data center utilization and enterprise adoption.

| Company | Ticker | Price Target | Rating | Key Markets |

|---|---|---|---|---|

| Public Service Enterprise Group | PSEG | $95 | Buy | Electricity and natural gas distribution |

| Alliant Energy Corporation | LNT | $74 | Buy | Natural gas and electricity in the Midwest |

| Sempra | SRE | $99 | Buy | Electricity and natural gas in California and Texas |

| Southwest Gas | SWX | $84 | Buy | Natural gas in California, Arizona, and Nevada |

| Xcel Energy | XEL | $84 | Buy | Electricity and natural gas in several states, including Colorado, Michigan, and North Dakota |

Deeper Dive: News & Info About This Topic

HERE Resources

San Diego Reports Highest Inflation Rate in the U.S.

Asian Stocks Climb Ahead of US-China Trade Talks

OPEC+ Increases Oil Production by 411,000 Barrels Daily

Stocks Surge in Japan and Taiwan Following Trade Deal

Oil Prices Steady after Saudi Arabia Signals Output Increase

Tesla Shares Tumble Amid Price Target and Tariff Challenges

Asian Stock Markets Experience Significant Declines

Author: STAFF HERE SAN DIEGO WRITER

The SAN DIEGO STAFF WRITER represents the experienced team at HERESanDiego.com, your go-to source for actionable local news and information in San Diego, San Diego County, and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as Comic-Con International, San Diego County Fair, and San Diego Pride Festival. Our coverage extends to key organizations like the San Diego Regional Chamber of Commerce and United Way of San Diego County, plus leading businesses in biotechnology, healthcare, and technology that power the local economy such as Qualcomm, Illumina, and Scripps Health. As part of the broader HERE network, including HEREAnaheim.com, HEREBeverlyHills.com, HERECostaMesa.com, HERECoronado.com, HEREHollywood.com, HEREHuntingtonBeach.com, HERELongBeach.com, HERELosAngeles.com, HEREMissionViejo.com, and HERESantaAna.com, we provide comprehensive, credible insights into California's dynamic landscape.