News Summary

Ken W. Mason, a 63-year-old real estate president in California, was arrested on federal charges for allegedly defrauding investors of nearly $30 million through a Ponzi scheme over 15 years. He faces multiple charges, including wire fraud and money laundering, and has been accused of misleading investors about the usage of their funds. Many victims have expressed relief following Mason’s arrest, as the investigation continues to uncover more details and encourage other potential victims to come forward.

California — Ken W. Mason, a 63-year-old real estate mogul from Sonoma, was arrested on federal charges related to an alleged Ponzi scheme that reportedly defrauded investors of nearly $30 million over 15 years. Mason faces multiple charges, including seven counts of wire fraud, one count of money laundering, and one count of obstruction of justice.

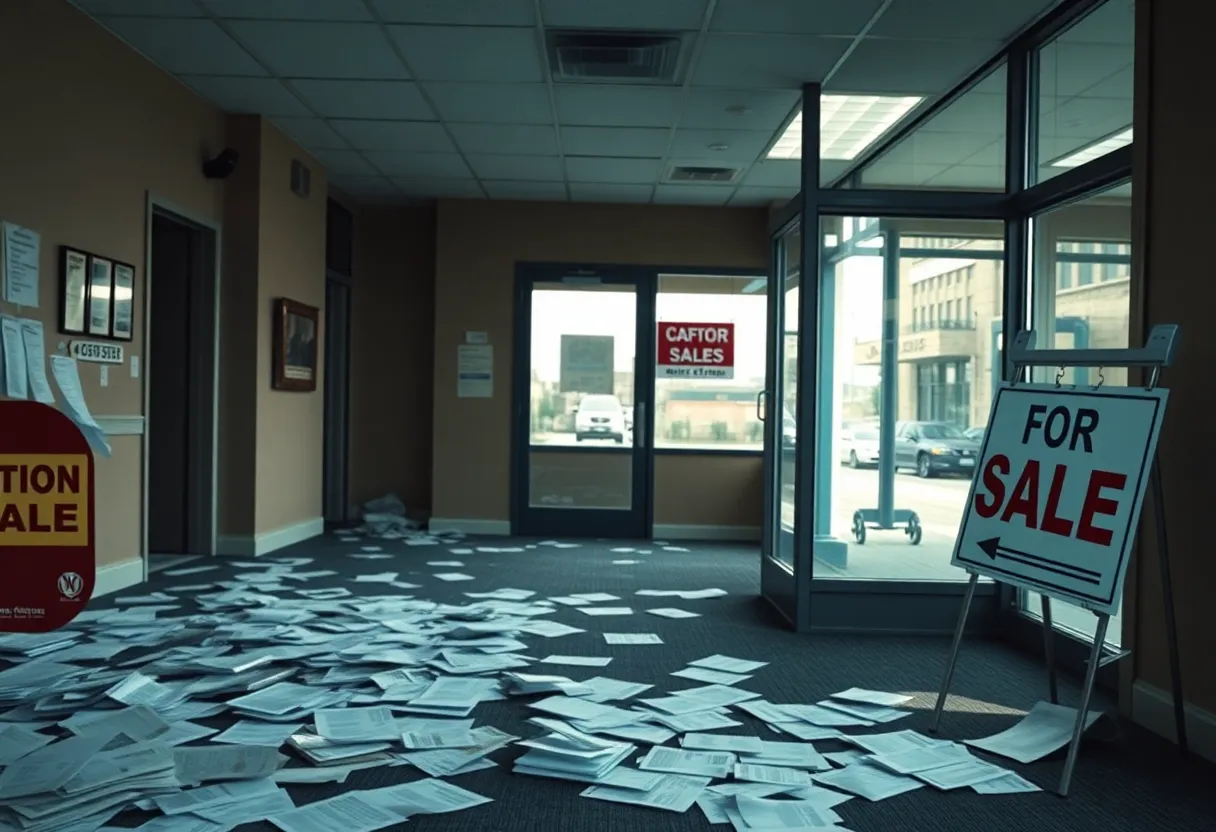

The accusations against Mason arise from his role as president of LeFever Mattson, a real estate company located in Citrus Heights, Sacramento County. Throughout his tenure, Mason managed several limited partnerships that dealt with both commercial and residential properties. He solicited investments from numerous individuals, many nearing or in retirement, by falsely presenting the investments as “legitimate and safe” opportunities.

Mason is alleged to have misled his investors about the usage of their funds. Rather than allocating investments into verified real estate partnerships, he purportedly funneled money into “off-books” arrangements. The investigation reveals that Mason sustained the scheme by redirecting funds from newer investors to pay returns to earlier ones, a classic hallmark of a Ponzi scheme.

According to acting United States Attorney Patrick D. Robbins, Mason’s activities suggest a deliberate effort to defraud investors, depriving them of their hard-earned savings, often their life savings. Investigations indicate that Mason’s fraudulent activities began in approximately 2009 and continued until 2024.

Some investors were led to believe that their funds were directed toward partnerships that owned an apartment complex. However, records from Mason’s company indicate that many of these individuals were never legitimate investors in the first place. Payments made to these “off-book” participants stemmed from a mixture of loans and funds from new investors, rather than returns from legitimate investment properties.

In a significant turn, Mason concealed the sale of an apartment complex that netted $8 million in proceeds. Even after selling the property, he continued soliciting investments under its name, further misleading investors. An investigation initiated by the Securities and Exchange Commission (SEC) in 2024 prompted Mason to allegedly delete over 10,000 relevant computer files, showing a possible attempt to hinder the inquiry.

Prosecutors allege that Mason misappropriated at least $28 million from investors in two specific companies tied to the Ponzi scheme. If convicted, he could face severe penalties, including a maximum of 20 years in prison for each count of wire fraud and obstruction of justice, and up to 10 years for money laundering.

In the wake of Mason’s arrest, many victims expressed a sense of relief and hope for eventual justice, given their substantial financial losses. The ongoing investigation continues to encourage other potential victims to come forth and share their experiences, suggesting that more individuals may have been affected by Mason’s alleged fraudulent activities.

In addition to the criminal charges, LeFever Mattson has filed for Chapter 11 bankruptcy, indicative of the financial chaos resulting from Mason’s actions. Following his arrest, investigators executed searches of Mason’s residences, unearthing additional evidence of purported financial misconduct.

Authorities have indicated that they are pursuing the seizure of properties owned by Mason in Piedmont and Del Mar if he is found guilty of the charges against him. Mason remains in custody, having pleaded not guilty to the allegations.

Deeper Dive: News & Info About This Topic

- CBS News: California Real Estate Mogul Kenneth Mattson Charged

- Wikipedia: Ponzi Scheme

- Press Democrat: Ken Mattson Sonoma Developer Ponzi Scheme

- Google Search: Ponzi scheme California real estate

- San Francisco Chronicle: Kenneth Mattson Federal Arrest

- Google Scholar: Ponzi scheme investigation

- Sonoma News: Mattson Sonoma Investor Arrested

- Encyclopedia Britannica: Real estate fraud

- Napa Valley Register: Ken Mattson FBI Developer

- Google News: Kent Mattson real estate Ponzi scheme